What are some ways for an entrepreneur to assess the performance of their Bookkeeper? 1. They’re always behind in responding to you. It will be frustrating if the bookkeeper takes more time to provide you with your company’s financial information. This goes along with general professionalism, which you should be […]

What exactly is a continuity plan? How to stay away from fiascos? Prepare yourself for them. At the point when things are working out in a good way, you frequently neglect to anticipate the terrible times. However, in a disaster, you could quickly lose everything. A seismic tremor can carry your […]

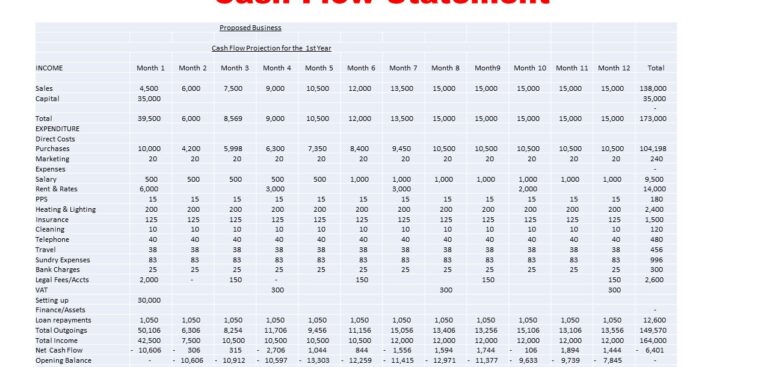

It is a massive problem for small business owners to maintain their finances and working capital as they need to follow proper accounting methods. I will discuss things that should have been done when you started the business. Firstly, to check the finances daily, you must have a cash flow […]

Achieving Financial Freedom: A Comprehensive Guide Financial freedom is a term that resounds with many but is truly understood by few. It represents a state where an individual has sufficient wealth to live a life of comfort and pursue their passions without being restrained by financial worries. Financial freedom involves a […]

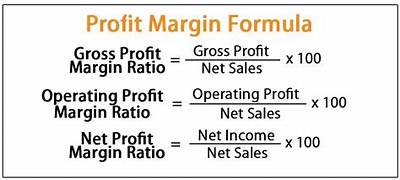

How do we measure financial health in a business using ratios? What is a financial ratio? Financial ratios are quantitative metrics that assess a company or organization’s economic health and performance. They give valuable insights into a company’s financial situation, helping investors, analysts, and management make informed decisions. Financial ratios are powerful tools that give valuable insights into a […]

A personal budget helps prevent debt by providing a correct approach to managing your finances. Here’s how it works: 1.Awareness of Income and Expenses Tracking Spending: A budget enables you to understand where your money goes by listing all income sources and tracking expenses. This awareness can prevent overspending and highlight […]

How do I get rid of business debt? If your business has accumulated more debt than it can handle, it’s crucial to figure out how to get things back on track. Neglecting the issue will only worsen matters and could ultimately dissolve your business. Here are seven ways to manage business […]

What are some things that someone without a finance background should know in personal finance (Most significant) Holy cow, but there’s a lot of bad advice here. As a younger man, I was a financial consultant, and here are some truisms about personal finance. 1. Do save money from this moment […]

Are turnover or profit margins more crucial for a new startup? Please explain the reasoning behind this. Companies with good sales might have low-profit margins. The reason could be that the price and costs are too low. Even though they make a good profit, the result could be a low profit […]

How would we keep away from obligation development in business? The following are five suggestions for assisting a business with escaping obligation and remaining as such. 1. Plan as long as possible. It’s easy to become involved with the everyday battles of maintaining a business; however, that mentality creates problems. Responding […]